In January 2023, Professors John M. Connor and Robert H. Lande published a paper on SSRN (forthcoming in the book Research Handbook on Cartels, edited by Peter Whelan) in which they discuss empirical economic evidence about the impact of price-fixing cartels. They base their findings on data collected from a multitude of public sources.

Introduction: median overcharge above 20%

Most importantly, the professors demonstrate that the validity of an earlier and widely cited study of the European Commission is upheld by the latest empirical evidence. In particular, the authors’ cartel dataset1Downloadable from https://purr.purdue.edu/publications/2732/2 (last accessed 23 January 2023). (“Private International Cartels Data”) – which contains now data points up to 2018 – confirms again that the median overcharge (i.e., typical overcharge) of price-fixing cartels is above 20%. That is, in the absence of cartels, prices would typically be a bit more than 20% lower in the affected markets. The median impact varies across the cartel episode investigated, type of conduct, geographical coverage, etc., but stays within the range of 17.1-27.5%.2Considering cartels from 2000 that are more relevant regarding their predictive power to future cases than earlier cartels.

Connor and Lande: sub-optimal cartel deterrence but average recovery rate is high

The authors also analyse the effectiveness of competition law enforcement, that is, whether the fines imposed by the authorities have the desired deterrence effect. If fines are equivalent to the cartelists’ profit expectations by forming a cartel, the deterrence is optimal (no over- or underdeterrence). Optimal cartel deterrence, in general, depends on two factors: (i) the firms’ (expected) profit from the cartel activity (i.e., overcharge x affected commerce) and (ii) the chances of being detected by the authorities (i.e., detection rate). Connor and Lande approximate the optimal level of fines by dividing (i) by (ii), that is, as a percentage figure of the affected commerce. Based on the underlying dataset, the paper shows that the optimal penalties on cartels should be in the range of 55.5%-110% of the affected commerce.3Depending on the type of cartel and time period, see Connor and Lande study, p. 21.

Consequently, Connor and Lande conclude that the deterrence level of cartel fines is worldwide suboptimal (for example, the imposed sanctions in the US are only 9-21% of their optimal level to discourage cartel formation4Connor and Lande study, p. 22.), but the study also seems to suggest that it is largely due to low cartel detection rates rather than a low level of penalties imposed.

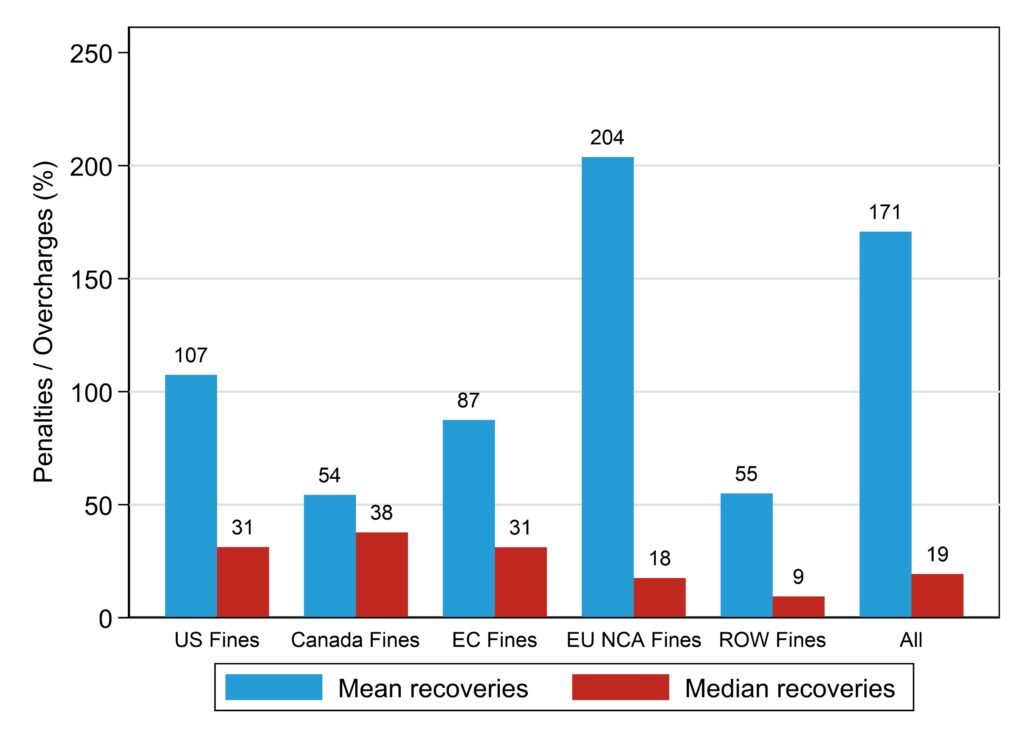

In particular, Section B.3. of the paper demonstrates that cartel injuries (i.e., anti-competitive profit made by the cartelists) are to a large extent recovered by the authorities through fines when the cartel is detected. The average recovery rate, which the authors define as a percentage figure of penalties/overcharges, is estimated at 174% (at 140% if the average is weighted5We have not managed to replicate the weighted average figure, lacking the information about the data points used as weights.). That is, on average, the fines imposed by competition authorities recover the injury caused by the cartel plus 74%. Further, the authors estimate the average recovery rate of national authorities in the EU to be even higher, at 204% (i.e., the fines imposed by national authorities in the EU recover more than two times the overcharge).

These figures alone are not meaningful concerning the total deterrent effects of cartel fines but they suggest that authorities, in general, are successful in recovering at least the harm caused to society – when the cartel is detected.

However, a deeper look into the data raises doubts about these conclusions.

Analysis: median recovery rate is low

Before examining the dataset, let us briefly outline the difference between mean (or average) and median. While the mean of a data sample is one of the most frequently calculated statistical measures, it can be highly influenced by only a few outliers. Median, on the other hand, shows the typical value of the sample6“The median is the value separating the higher half from the lower half of a data sample […] For a data set, it may be thought of as “the middle” value.” (Wikipedia: https://en.wikipedia.org/wiki/Median). and is less susceptible to outlier values. If there is a significant difference between the mean and the median of a data sample, one should carefully check whether there are any outliers that influence the mean. If there are, the calculated average value can be misleading.7When considering optimal deterrence, Connor and Lande also ask the question whether using mean or median overcharges are better (see Connor and Lande study, p. 21.) but they do not reach a conclusion.

The below chart shows that the average values as reported by Connor and Lande in Section B.3. of the paper are over-optimistic concerning cartel fines. First, we replicate the values shown in the paper (blue bars8Some of our figures are slightly different from that of the Connor and Lande study. This may be explained by slight differences in the sample selection procedure.), then we add the median values for the same data samples chosen by the authors (red bars). The statistics calculated show that, in each geographical region, the median recovery rate is significantly below the average recovery rate. Considering all geographical regions in the dataset together we can observe that while the average recovery rate is 171% (Connor and Lande calculate a slightly higher figure, 174%), the median recovery rate is only 19%.

Figure 1 – Mean and median recovery rates, by geography

Source: Private International Cartels Data

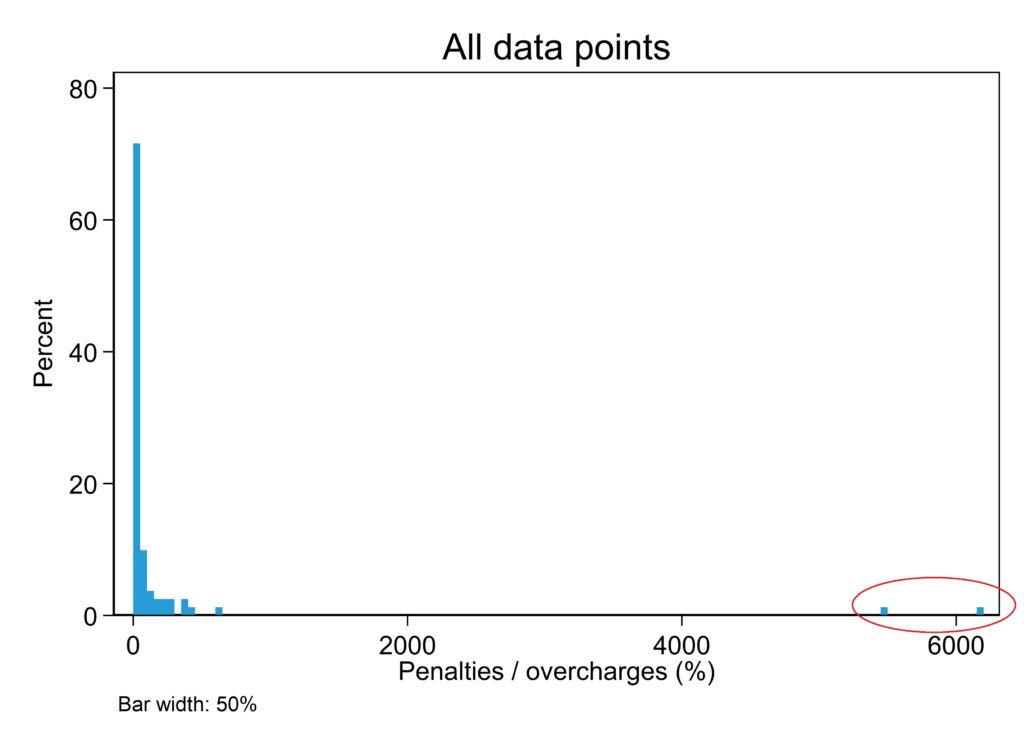

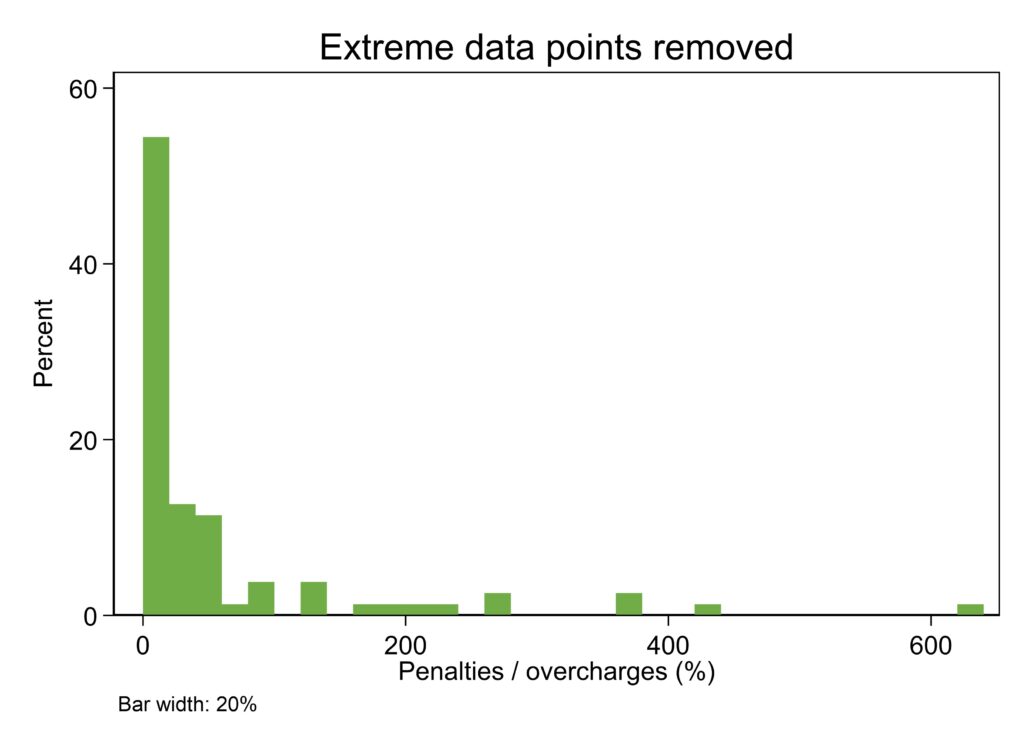

The issue is even more visible if we zoom in on the highest value presented by Connor and Lande for the national competition authorities in the EU (“EU NCA Fines”, above 200% average recovery rate). Figure 2 below shows frequency charts for recovery rates calculated by the authors for each individual cartel investigated (and fined) by EU national authorities in the dataset.

Figure 2 – Recovery rates of individual cartels, national competition authorities in the EU (percentage of total number of cartels)

Source: Private International Cartels Data

It becomes clear from the figure on the left-hand side that the average of the individual recovery rates is highly influenced by just two data points with extremely high recovery rates. These can represent genuine observations, but they may be data anomalies. Either way, as these outliers heavily influence the mean, the average recovery rate as reported by Connor and Lande is not representative of the sample. In fact, the frequency chart on the right-hand side without the two extreme values shows that more than half of all the observations in the sample indicates a recovery rate of less than 20% (again, the sample consists of individual cartels fined by EU national authorities). This is in line with the median figure (18%) calculated above.

Conclusion: effective private enforcement

The results cast doubt on the implications of Section B.3. of the study by Connor and Lande, as the median recovery rates in the samples selected are, in contrast to averages, significantly lower than 100%. That is, not only the fines imposed by authorities have insufficient deterrent effects but, even if the cartel is detected, they typically do not even make up for the negative effects (overcharge) of the cartels. The median recovery rates suggest that cartel effects can be five times higher than cartel fines.

Private enforcement is an effective tool to recover financial damages by market participants that suffer the consequences of (price-fixing) cartels. Further, as (potential) cartelists simultaneously face risks of public and private enforcement – at least in the EU –, private enforcement plays a prominent role in cartel deterrence.

By Akos Reger