The recent publication on the determination of the period of actual collusive effects by Boswijk, Bun, & Schinkel (“BBS”) is rather timely given the upsurge in private antitrust enforcement across Europe since the introduction of the EU Damages Directive (“Directive”) and its subsequent implementation into Member State law.

Background – The Right to Full Compensation

The Directive acknowledges the right to full compensation (Article 3) while stating in relation to passing-on the unjust enrichment from ‘over-compensation’ of a claimant (Article 12) and ‘the absence of liability of the infringer’ (Articles 12(1) and 15(1)) shall be avoided. Great emphasis has been placed by the Directive on the issue of passing-on but arguably an even more relevant factor in relation to the right to full compensation is in fact the determination of the actual period for which a cartel resulted in artificially inflated prices.

There is consensus among economists that cartels can lead to damages after the official end date of an infringement and in these circumstances the use of official infringement dates to quantify damages may lead to estimations of harm that are not based on market reality. For example, the Oxera study prepared in 2009 for the European Commission in the context of offering non-binding guidance for courts on quantifying antitrust damages, states:

“[I]t may take some time for the cartel behaviour to unwind fully and for the market to return to non-infringement-based pricing. Indeed, in the case of cartels, unwinding may take a substantial period, since knowledge of business secrets revealed during the cartel period may persist for a long time.”

There are a variety of reasons why official infringement dates are often not the same as the beginning or end dates of the anticompetitive effect. These include:

- Prices agreed during a cartel take time to be implemented, or become ineffective before the cartel ends, or take time to return to competitive levels after the cessation of the cartel;

- Extended explicit collusion after the official infringement end date;

- The official infringement period was subject to settlement negotiations between the respective competition authority and the cartelists;

- Extended tacit collusion after the official end date of the infringement;

- Medium and long-term contracts concluded under the cartel regime remain in place after the cartel;

- Reduced capacity and number of incumbents takes time to rebuild.

The use of economic analysis to determine whether the effects of a cartel last longer than the official cartel duration is highlighted by the European Commission in its Practical Guide:

“[O]ften doubt exists regarding the exact beginning of an infringement and, in particular, the effects it produces. (…) Econometric analysis of observed data can be a way to identify when the infringement’s effects started or ceased.”

Cartel Dating by BBS

The results of BBS’s analysis show that if incorrect cartel dates are used in multivariate regression models to quantify overcharges an effective bias is introduced leading to an overestimation of counterfactual prices and an underestimation of overcharges. According to BBS, this bias can be mitigated by determining the effective dates in a more precise manner.

To avoid such a bias BBS uses formal statistical tests for multiple structural change which were developed by Bai and Perron (1998, 2003). These tests determine the number and dates of the effective cartel periods in a price time series by estimating structural breaks in the specification, such as those caused by a switch from competition to collusion, and vice versa. The estimated breaks in the time series are interpreted as the dates when the cartel started to become effective or began to lose its effectiveness.

An alternative cartel dummy regressor is constructed conditional on the estimated number of breaks and estimated break dates. This cartel dummy is then used in the regression analysis instead of the official cartel dates to estimate the cartel effects. The actual effects of the cartel are therefore established including whether these effects were continuous or instead consisted of multiple collusive episodes with intervening competitive periods.

Application to Market-wide Data

BBS apply their structural break approach to a monthly average sodium chlorate price series which was constructed by standard methods from invoice data of over 34,000 individual transactions between customers and suppliers of sodium chlorate representing about 45% of total European demand during the relevant period. The use of such market-wide data serves as a reliable basis for a robust analysis. The model also includes the primary factors known to determine price in the sodium chlorate industry such as demand, production capacity, and the cost of electricity and labour.

The empirical findings corroborate the theoretical results. When using the official cartel dates the model returns coefficients of these explanatory variables that are all insignificant whereas when applying the effective cartel dates instead, all coefficients have the expected sign with capacity and electricity costs the most important determinants of price as expected.

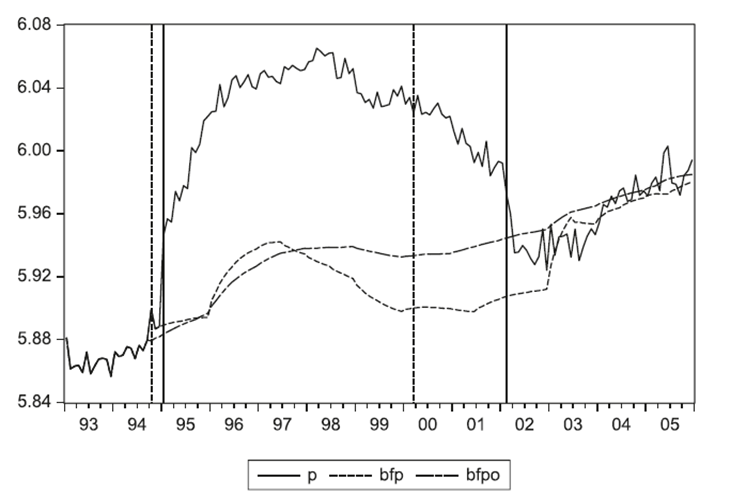

The graph below is a reproduction of Figure 3 in BBS’s publication. It shows the actual sodium chlorate price (solid line, p), together with the counterfactual price using the effective cartel dates (short-dashed line, bfp) and using the official cartel dates (long-dashed line, bfpo).

The results from using market-wide data demonstrate that the cartel resulted in a single and continuous period of cartel effects. While the cartel became effective not long after the official start date (left vertical dashed line), overcharges extended for a long period after the end date of the cartel referenced in the Commission Decision (right vertical dashed line). In this example, the impact of using the incorrect official dates is an underestimation of overcharges by more than 25%. This considerable difference clearly shows the problematic effect of mis-specifying the cartel start and end dates. The largest part of this difference is due to the official end date falling before the effective end date.

Conclusion

Given the valid reasons to suspect official cartel dates are more legal formality rather than economic reality, the publication by BBS on cartel dating is a very valuable addition to economic literature on the quantification of overcharges and the effectiveness of cartels. The publication demonstrates that the use of proper cartel dates is essential for obtaining an accurate estimation of overcharges and failure to do so can lead to a significant underestimation. This scientific contribution will help to serve both claimants and defendants in more precisely assessing the level of realistic damages while also providing added value to judges in their determination of the right to full compensation.

By Pádraic Burke