On 22 June 2021, the European Commission confirmed the opening of a formal antitrust investigation into whether Google previously abused or is currently abusing its dominant position in the online intermediation of programmatic display advertising business. Prior to the Commission’s announcement, the French Competition Authority (FCA) had already handed down a decision on 7 July 2021, including a EUR 220 million fine, finding that Google breached Article 102 TFEU and the French Competition Act in the same advertisement sector.

Google settled with the FCA and, on the back of the settlement decision, Google agreed to make changes to its ads business, the first time the US tech company officially agreed with a competition authority to change the way it conducts its business in the sector contributing to the bulk of its revenue. Google agreed with the FCA to the appointment of an independent trustee to monitor its commitment to levelling the playing field for a period of three years to improve conditions in the sector. Google announced that it will not appeal the FCA decision, and it may roll out some of the changes on a global scale, the impact of which including implications for the Commission’s investigation remain to be seen.

Intermediation of programmatic display advertising? What is it all about?

Brief description of ad-tech

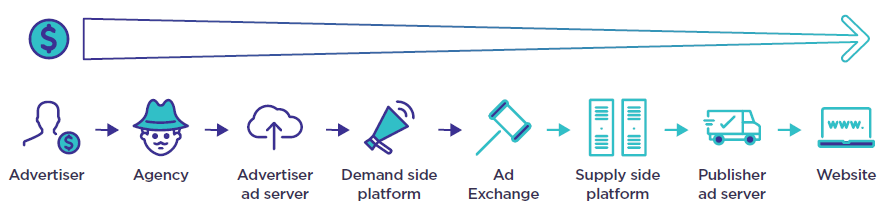

The intermediary players connect two sides of the programmatic display (impression-based) advertising. On the one hand, online publishers own designated ad-spaces (for example, on the website of an online newspaper, also called inventories) that they want to sell to advertisers at a maximum price. On the other hand, advertisers are seeking the best solutions via targeted advertisement to place their ads online with the highest expected impact for the lowest price. Programmatic advertisement occurs in real time, often within a fraction of a second.

- Sell side: the publisher’s ad server sends the information to a supply-side platform (SSP) that the inventory is available on the webpage opened. SSPs manage the inventory-selling process via an ad exchange acting as a trading platform. Over time, many SSPs and ad exchanges became one integrated platform.

- Purchase side: advertisers (advertisement agencies) use ad-servers to manage the ad campaign and demand-side platforms (DSP) to bid for inventories. The DSP evaluates the opportunity based on objectives of the ad-campaign and send bids via the ad exchange to the SSP. This is the purchase side of ad-tech.

The SSP ranks the bids received based on price and other objectives pre-determined by the publisher and decides the winner. The winning advertisement then appears on the webpage while the user downloads the content.

Source: ACCC, Digital Platforms Inquiry, Final Report, June 2019, p152.

Google is active in all segments of the ad-tech vertical chain, and most of the ad trades flow through the following Google intermediaries: Doubleclick for Publishers (DfP) is active in the publisher ad server segment; AdX is an ad-exchange/SSP; Display & Video 360 (DV360) is a DSP, Campaign Manager is an ad server for larger advertisers; Google Ads is an integrated DSP and ad server for smaller advertisers.

Ad-tech investigations

According to its press release, the Commission is examining many business conducts of Google, but apparently from a different angle than the investigation just closed by the FCA. The FCA looked at the sell side of display advertising (Google’s DfP favouring Google’s own ad-exchange AdX and vice versa), whereas the Commission seems to mainly focus on the purchase side, looking into whether Google misused the market position of DV360 and Google Ads (Google’s advertisement-side platforms), in combination with AdX, to restrict competition.1 Such a division of labour between the two authorities is unusual but it would nevertheless ensure that the two authorities do not reach conflicting conclusions.

While the Commission is unlikely to shed much light on the details of their investigation any time soon, it is possible that Google’s (i) dominance and (ii) the abuse of that dominance will be confirmed in the coming years. After all, various authorities and complainants have been ringing the bell for some time claiming substantial issues exist with the intermediation markets in online display advertising. The FCA’s decision already confirmed that Google’s business conduct was anti-competitive.

Antitrust damages based on the FCA decision

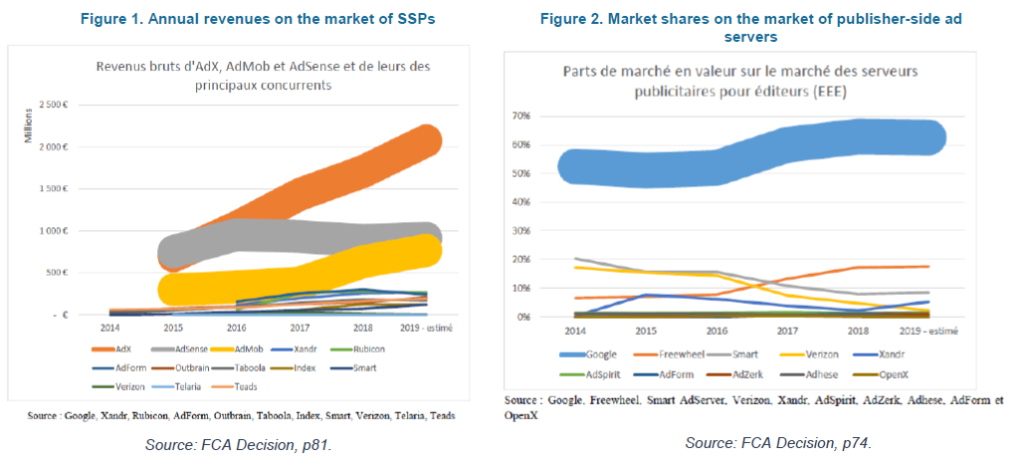

The FCA decision also confirms that companies operating in the online intermediation sectors, especially small ones, were likely negatively affected by Google’s abusive practices.2 The quantification of the financial damages caused by Google’s practices requires an estimation of counterfactual revenues. While this is a comprehensive numerical exercise with multiple factors to consider, it is highly likely that Google would not have gained such a large difference in market share vis-à-vis their competitors as shown in the below charts, had the anti-competitive practices not occurred.

Furthermore, according to the FCA, online publishers were also potentially damaged as their advertisement inventories could not always be sold at the highest purchase price.3 To this, one might also add the losses stemming from unsold advertisement space or from the service quality reduction due to the latency in the appearance of the winning ad4 because, for example, certain SSPs were unable to (effectively) bid for the inventory. Note that the total damage suffered by publishers can be substantial as, according to the FCA decision, the relevant geographic market is the territory of the EEA.5 Hence, all online publishers – large or small – making use of programmatic advertising could have been affected in any of the EEA countries.

Publishers may not only have been harmed by the suboptimal price at which the inventory was sold to advertisers, but also by the high take rate that Google retained for every inventory sold. It can be expected that, in the absence of Google’s abusive practice, competing publisher ad-servers and SSPs would have exerted stronger competition to effectively reduce the take rate on the sell side of the ad-intermediaries market, leaving more profits with publishers.

Antitrust damages based on the future Commission decision

It is quite possible that the Commission will reach similar conclusions with respect to the sell side of the online intermediation markets meaning Google could be found dominant in those segments too and if so, it may have abused that dominant position through various ways of self-preferencing and excluding competitors.

If the Commission issues such a decision, several categories of potentially damaged businesses would exist. First, there are competing DSPs and advertiser ad servers that may have been unable to compete effectively with Google’s demand-side services DV360 or Google Ads. Second, as advertisers typically work with targets achieved within a certain budget (ad-campaign), with stronger competition in the ad-intermediary segments they may have been able to purchase advertisement space at a lower cost (advertisers typically pay ad-tech intermediaries services based on a per-thousand impression basis). Third, as advertisers are setting their willingness to pay for different inventories rather than paying a pre-set price, it may also be the case that publishers are harmed by advertisers’ lower willingness to pay due to the abuse (they would have potentially purchased more advertisement space or at higher prices in the absence of the infringement).

By Akos Reger

1. On the supply side, the Commission will be looking into the ability of publishers and competing ad-intermediaries to access relevant user data. ↩

2. FCA Decision, para. 449. ↩

3. FCA Decision, para. 450. ↩

4. Perhaps the site viewer has already navigated away or scrolled down, not seeing the ad. ↩

5. FCA Decision, paras. 286 and 305. ↩